What are the different types of taxes in Australia?

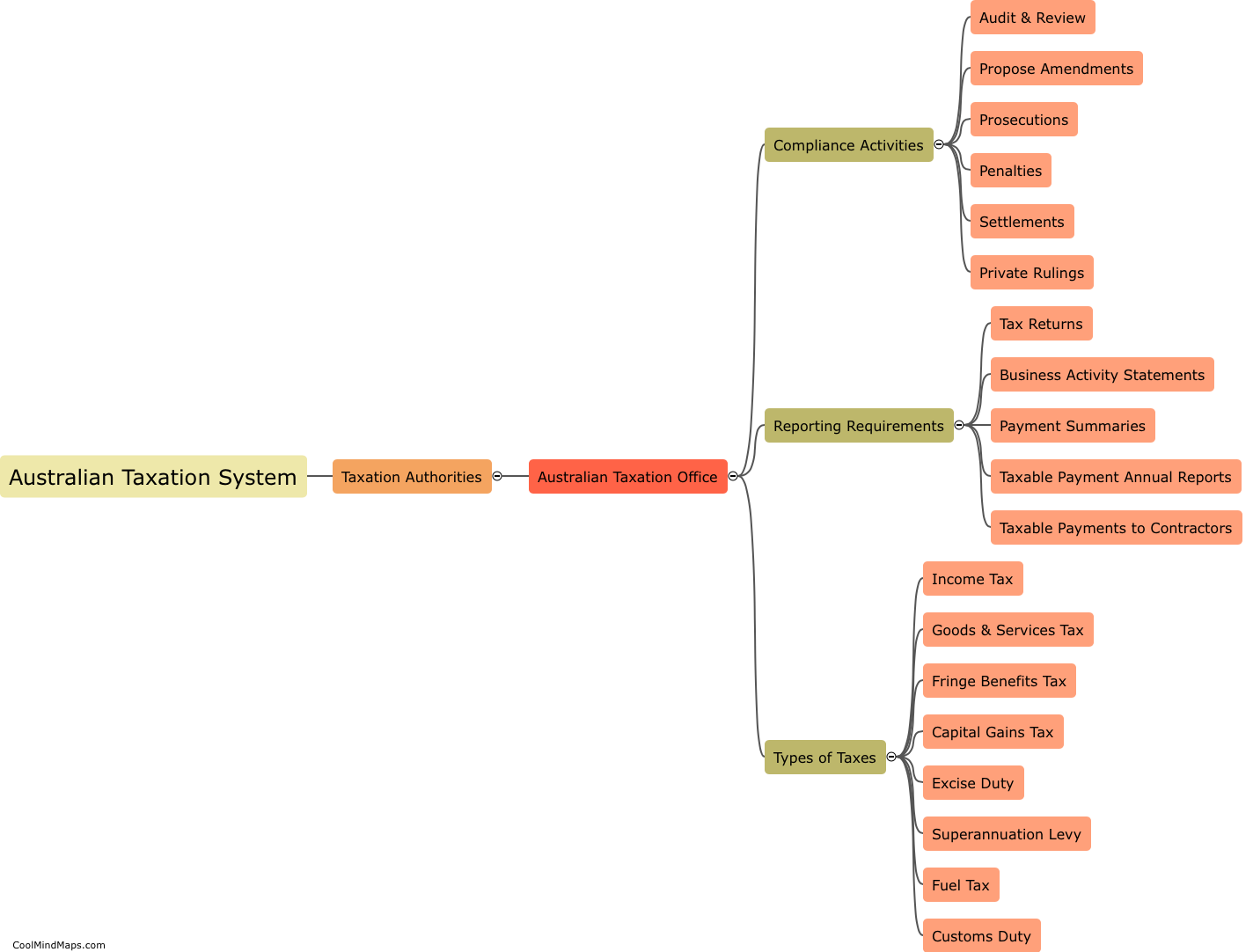

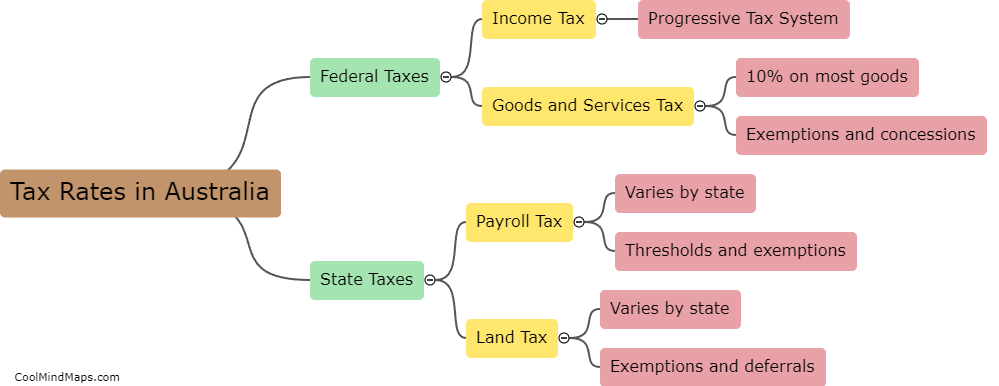

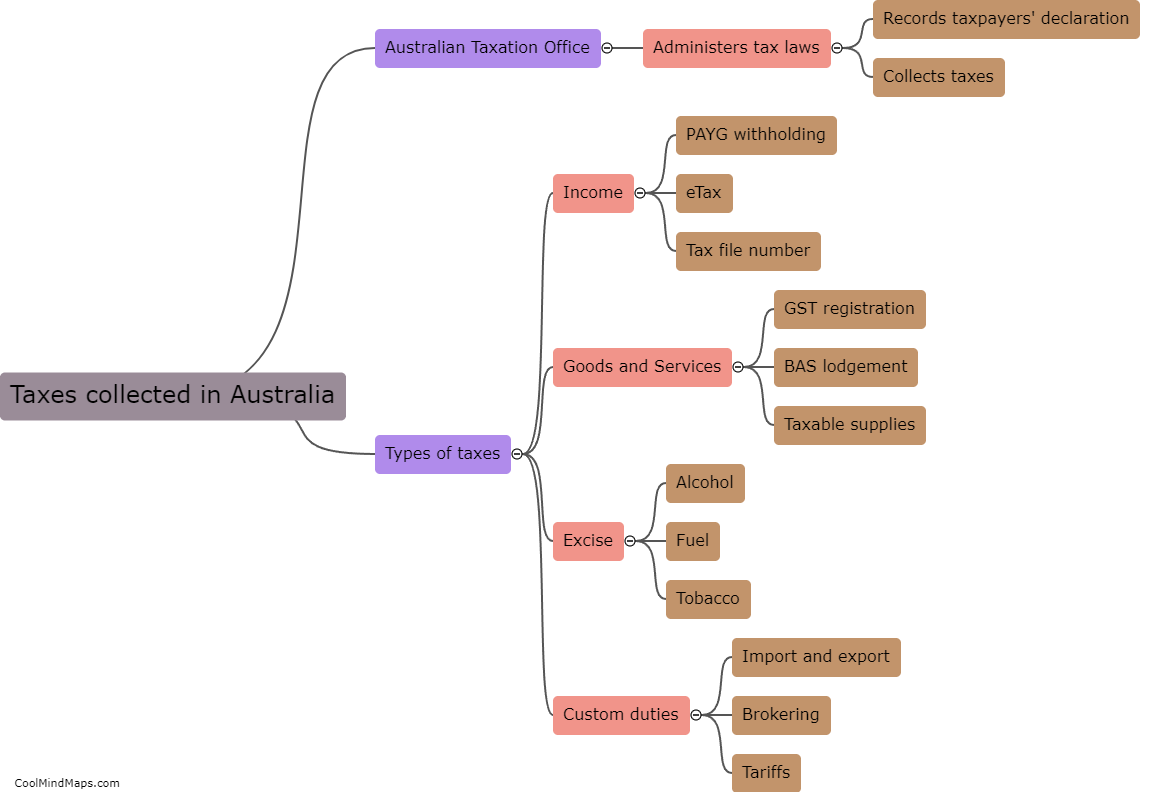

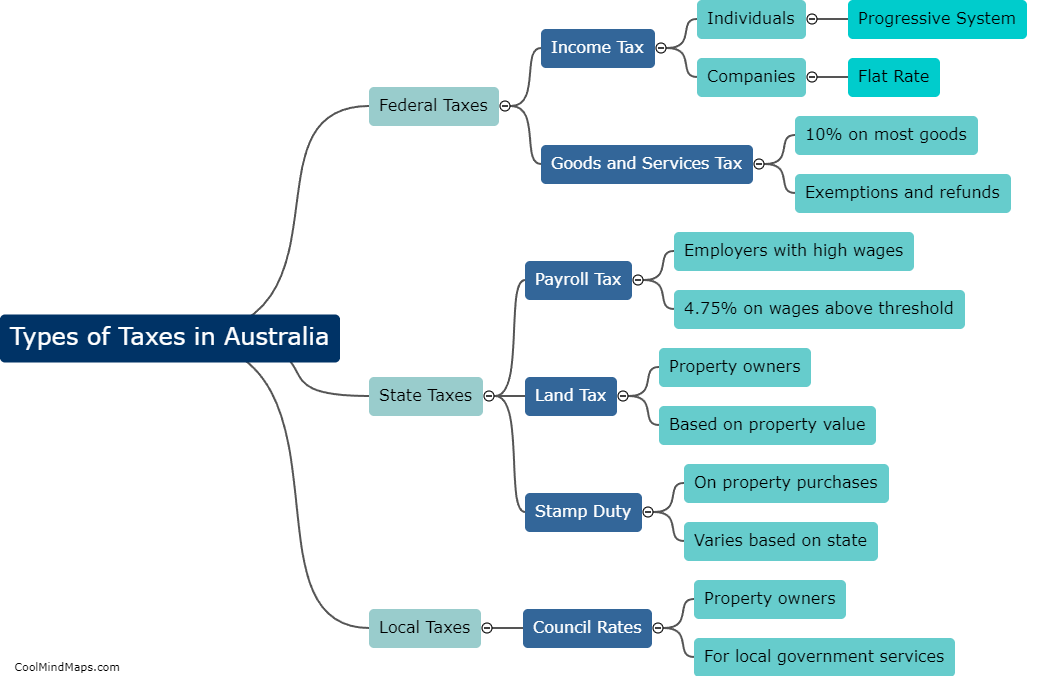

There are different types of taxes in Australia, including income tax, goods and services tax (GST), corporate tax, capital gains tax, and fringe benefits tax. Income tax is calculated as a percentage of an individual's total earnings, while corporate tax is a tax paid by companies on their profits. Capital gains tax is levied on individuals and businesses on any profits made from the sale of assets such as property or shares. Fringe benefits tax is paid by employers who provide their employees with non-cash benefits such as company cars or travel allowances. Finally, GST is a value-added tax on most goods and services sold in the country.

This mind map was published on 22 May 2023 and has been viewed 100 times.