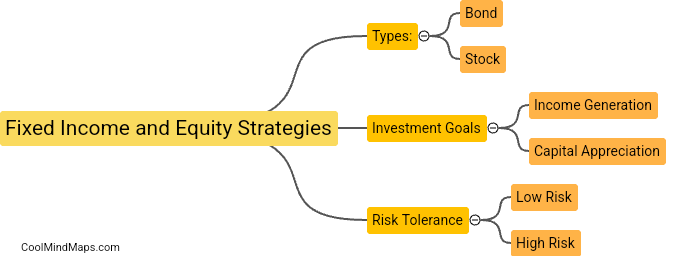

How are fixed income and equity strategies related?

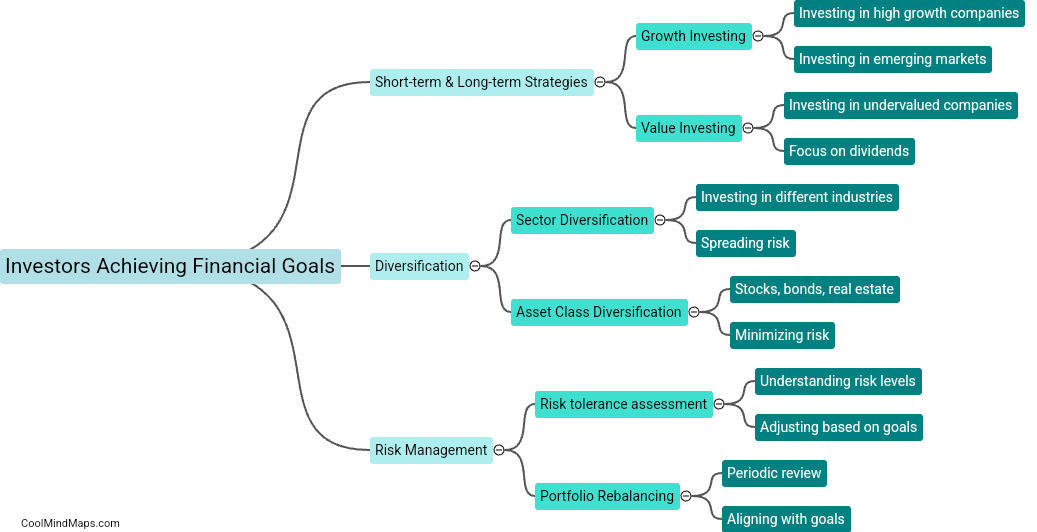

Fixed income and equity strategies are related in that they both play crucial roles in a well-diversified investment portfolio. While fixed income investments such as bonds offer steady income and act as a cushion against market volatility, equity investments such as stocks have the potential for higher returns over the long term. By combining both fixed income and equity strategies, investors can achieve a balance between stability and growth in their investment portfolio, helping to mitigate risk and maximize returns.

This mind map was published on 3 April 2024 and has been viewed 89 times.