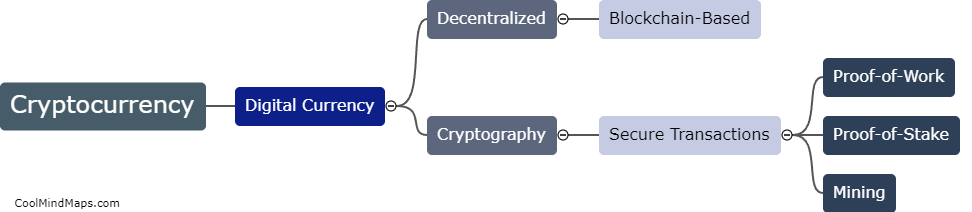

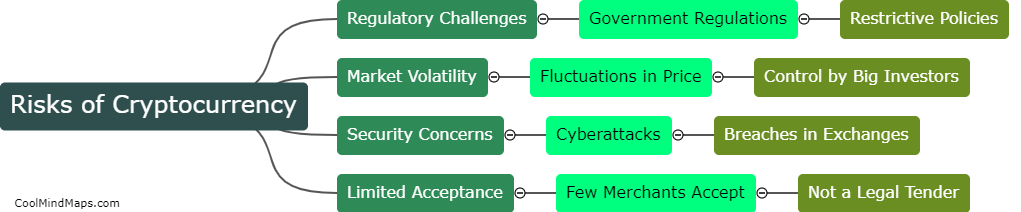

What are the risks of investing in cryptocurrencies?

Investing in cryptocurrencies involves significant risks, such as market volatility, technological risks, and regulatory risks. The price of cryptocurrencies is highly volatile, and investors could lose a substantial amount of their investment overnight. Additionally, fraudulent activities, cyber-attacks, and hacking incidents have become prevalent in the crypto market, which could compromise investors' security and result in significant losses. Furthermore, the regulatory landscape surrounding cryptocurrencies is constantly evolving, and investors may face legal consequences if they violate laws and regulations. As a result, investors should thoroughly educate themselves about cryptocurrencies and carefully assess the associated risks before investing.

This mind map was published on 18 April 2023 and has been viewed 95 times.