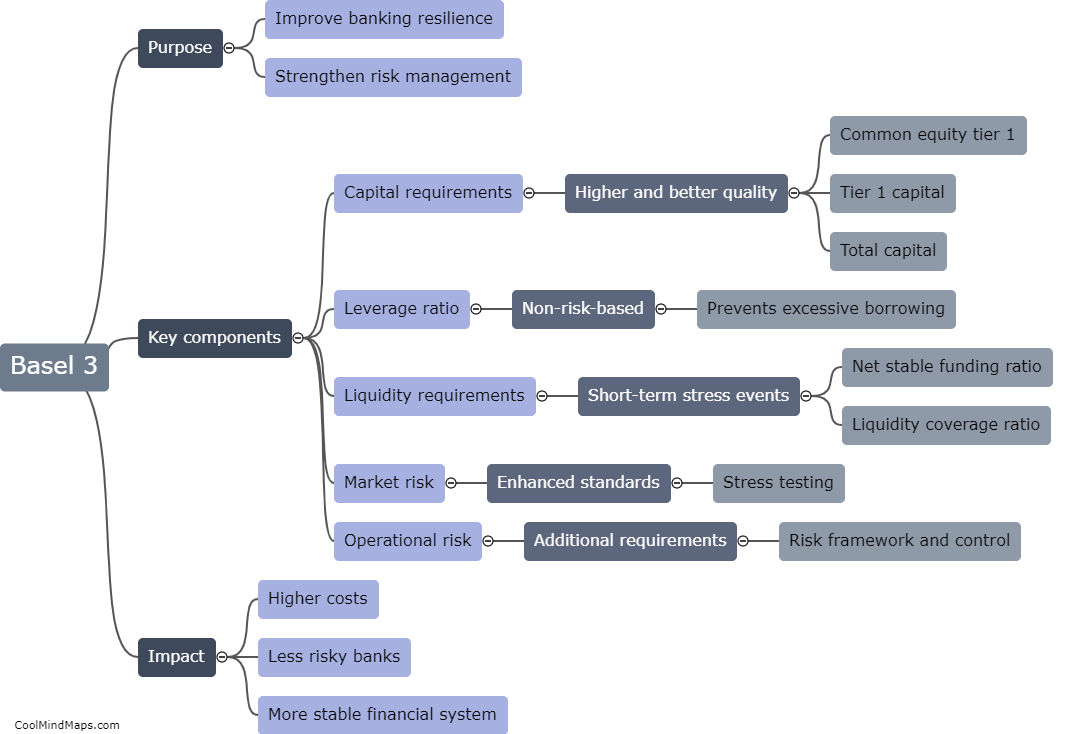

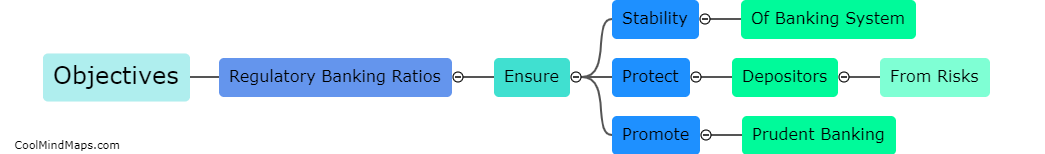

What are the objectives of regulatory banking ratios?

The objectives of regulatory banking ratios are to ensure the stability and safety of the banking system, protect depositors' funds and limit the potential for banks to take on excessive risk. Regulatory ratios, such as the Capital Adequacy Ratio (CAR) and Liquidity Coverage Ratio (LCR), act as a safeguard against financial crises by ensuring that banks maintain sufficient levels of capital and liquidity to absorb potential losses. These ratios also provide a means of comparison between different banks, as they are required to report their regulatory ratios to regulators. Overall, the objectives of regulatory banking ratios aim to promote a stable and healthy banking system that benefits both financial institutions and their customers.

This mind map was published on 23 May 2023 and has been viewed 101 times.