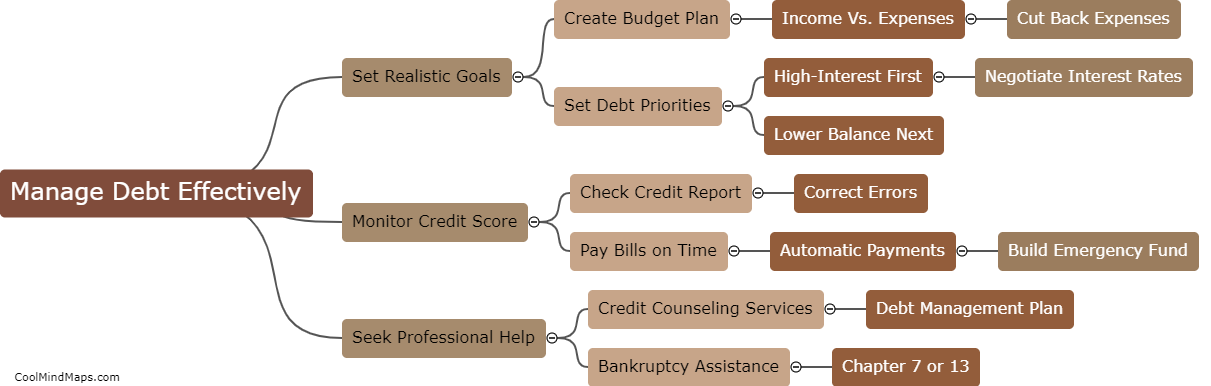

How to manage debt effectively?

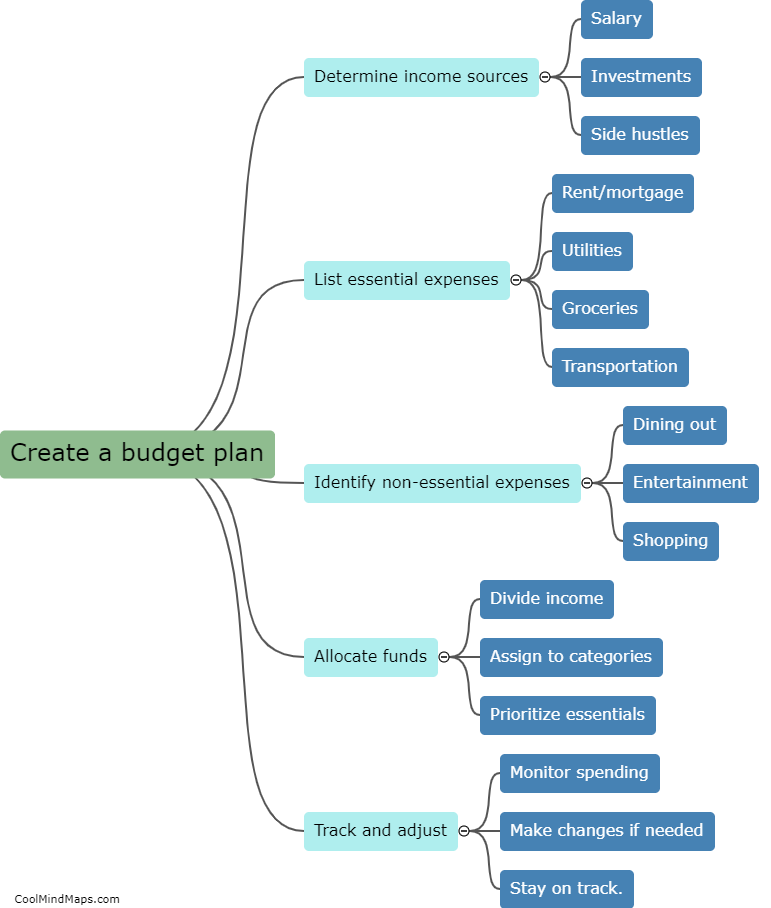

Managing debt effectively can be a daunting task, but it is essential to maintain financial stability. Firstly, it is important to create a budget, prioritizing essential expenses and cutting back on non-essential ones. Secondly, regular payments should be made to creditors while avoiding late fees and penalties. Refinancing or consolidating debt could also help by lowering monthly payments or interest rates. Another key aspect is reducing unnecessary debt, by paying off the highest interest rate credit card or consolidating all debts into a single low-interest loan. Finally, seeking professional advice from financial experts or credit counselors could help individuals to manage their debt effectively.

This mind map was published on 17 April 2023 and has been viewed 101 times.