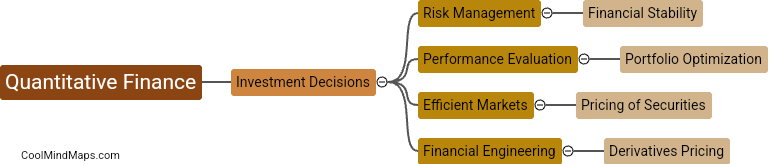

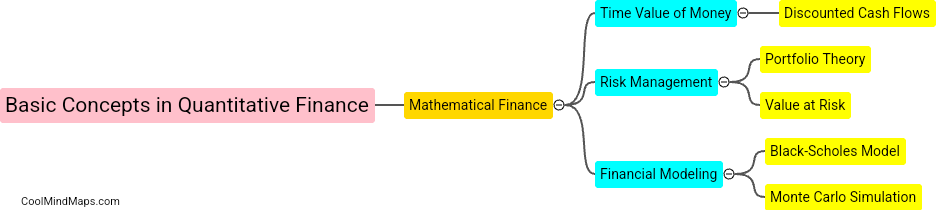

What is the Black-Scholes method?

The Black-Scholes method is a mathematical model used to calculate the theoretical price of European-style options. Developed by economists Fischer Black and Myron Scholes in 1973, the model takes into account various factors such as stock price, strike price, time to expiration, interest rates, and volatility. This method revolutionized the financial industry by providing a way to more accurately price options and manage risk in the derivatives market. It is widely used by investors, traders, and financial institutions to make informed decisions about options trading.

This mind map was published on 2 April 2024 and has been viewed 90 times.