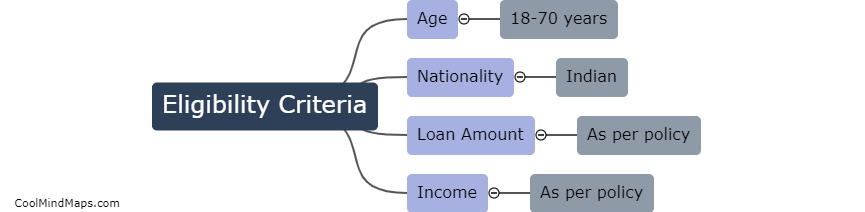

What are the eligibility criteria for an IBA loan?

The eligibility criteria for an IBA (Indian Banks' Association) loan in India typically involve various aspects. First and foremost, the borrower must be an Indian citizen or a Non-Residential Indian (NRI) living abroad. They should have a regular source of income and should be within the prescribed age limit, which may vary depending on the type of loan. The applicant must also have a good credit history and a decent credit score, indicating their ability to repay the loan. Additionally, the borrower may need to provide collateral or a guarantor depending on the loan amount and type. These criteria ensure that the borrowers are financially stable and capable of fulfilling their loan obligations.

This mind map was published on 21 September 2023 and has been viewed 116 times.