How does Bain Capital evaluate potential sports investments?

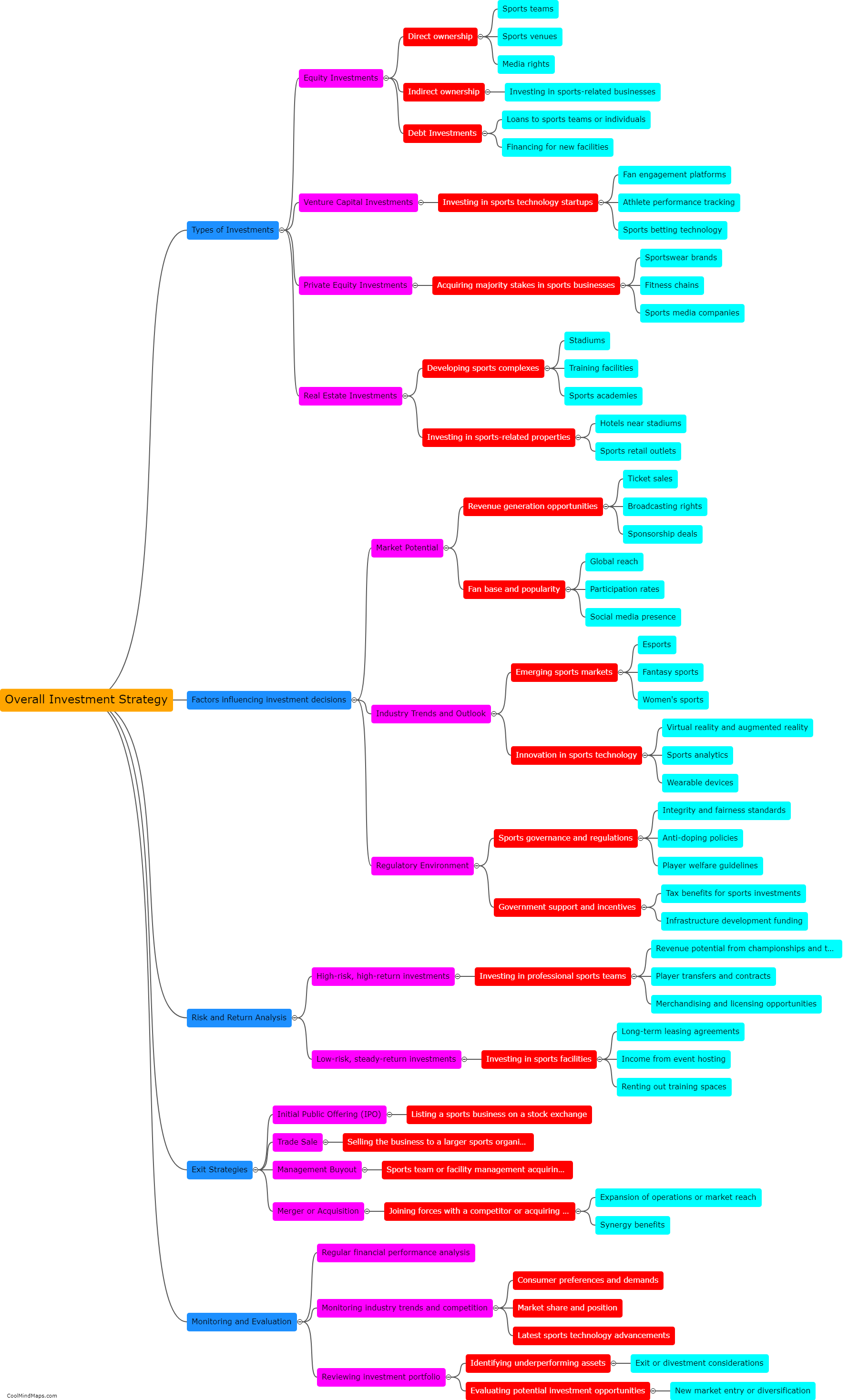

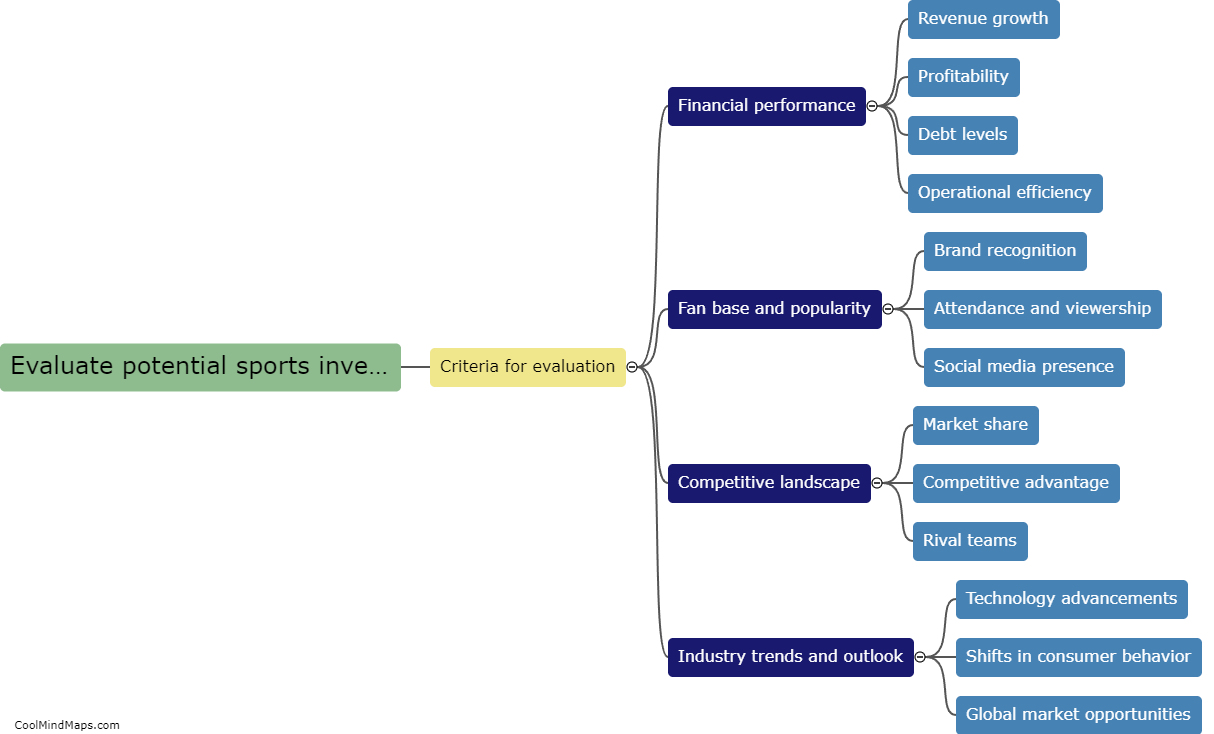

Bain Capital, a leading private investment firm, follows a rigorous evaluation process when assessing potential sports investments. Firstly, they examine the financial aspects, analyzing the team's revenue streams, costs, and profitability. They assess the team's revenue potential, considering factors such as media rights, ticketing, merchandising, and sponsorships. Additionally, Bain evaluates the team's market position and potential for growth, analyzing their fan base, regional competition, and market trends. They also consider the team's management and ownership structure, assessing the leadership's capability and track record. Lastly, Bain Capital conducts thorough due diligence to identify any potential risks or legal issues. Through this comprehensive evaluation process, Bain ensures that potential sports investments align with their investment criteria and have the potential to deliver strong returns.

This mind map was published on 10 November 2023 and has been viewed 92 times.