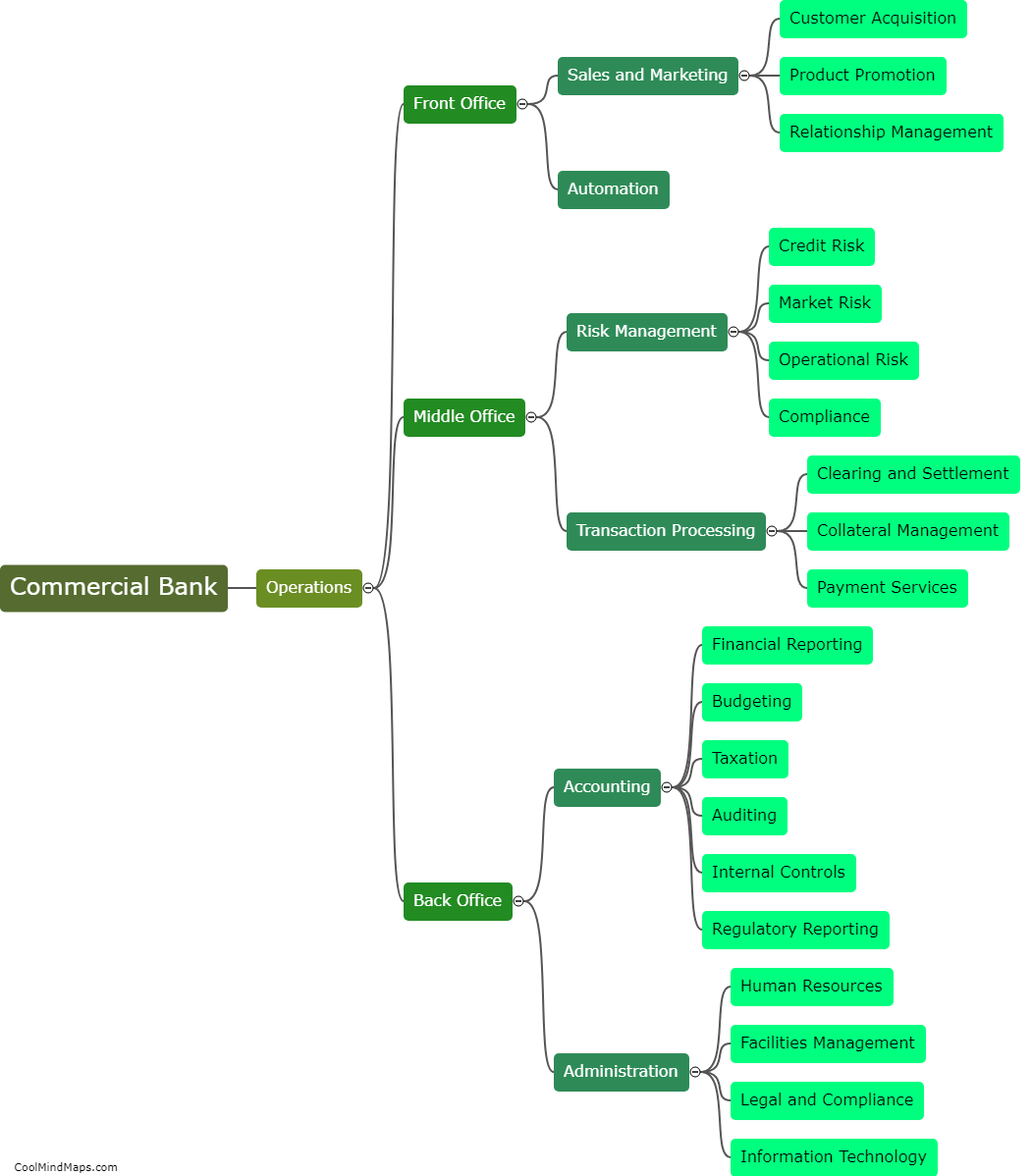

How do different departments in a commercial bank operate?

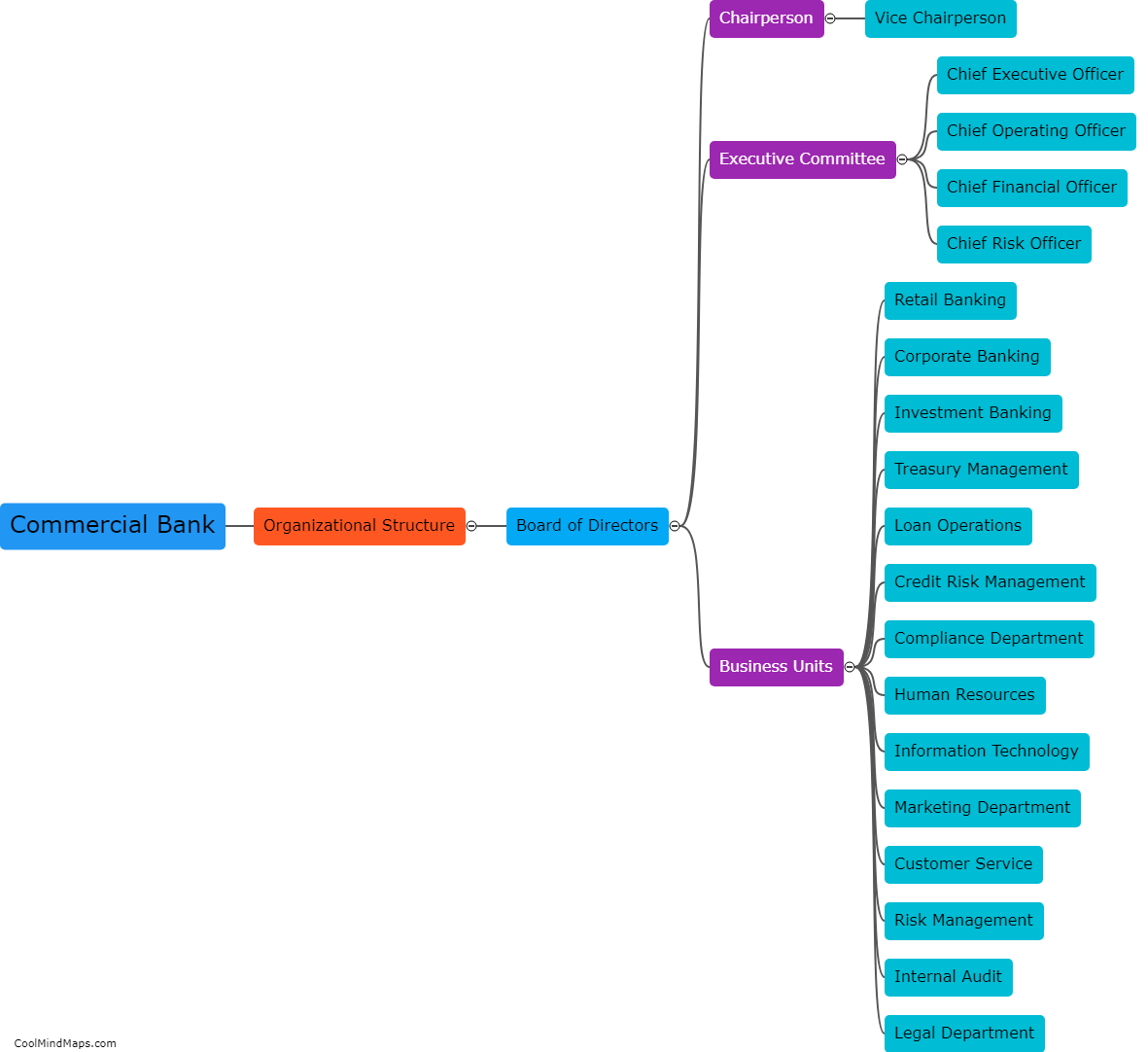

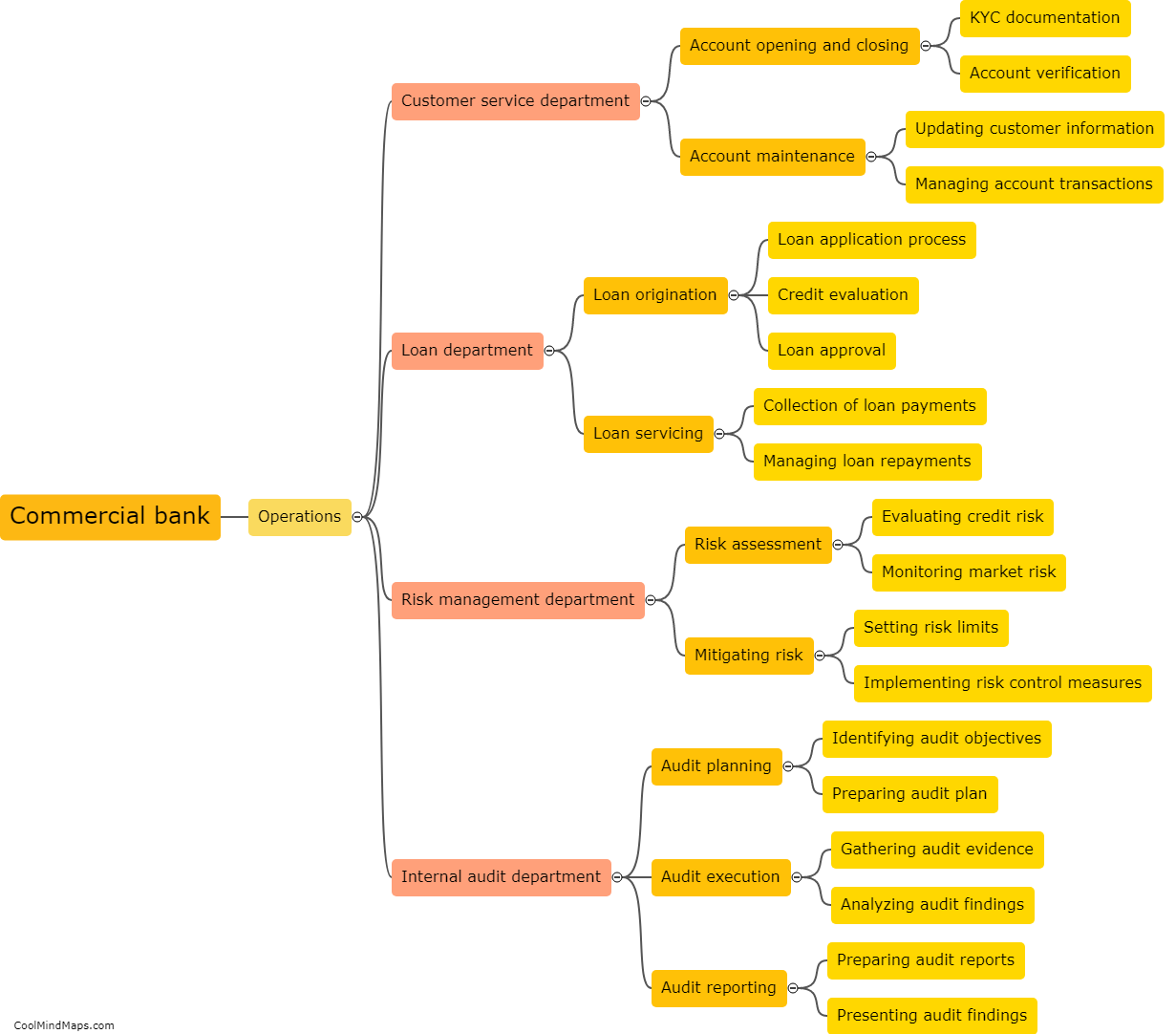

Different departments in a commercial bank operate together to ensure the smooth functioning of the financial institution. The most crucial department is the front office, which includes customer-facing teams such as the tellers, loan officers, and customer service representatives. Their primary role is to handle customer transactions, facilitate loan requests, and address customer inquiries and complaints. The middle office department, consisting of risk management and compliance teams, focuses on monitoring and managing various risks, ensuring adherence to legal and regulatory requirements, and maintaining internal controls. The back office department handles administrative tasks and provides operational support, such as processing customer transactions, managing accounts, and maintaining records. Additionally, the back office may include support teams like IT, human resources, and marketing, which play a crucial role in maintaining the bank's overall operations. Overall, these departments work collaboratively to deliver essential banking services, manage risks, maintain compliance, and ensure customer satisfaction.

This mind map was published on 19 July 2023 and has been viewed 120 times.