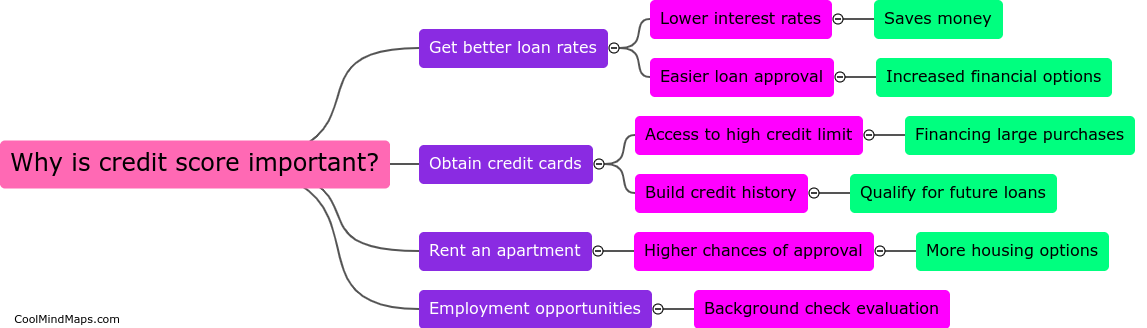

Why is credit score important?

A credit score is a numerical representation of an individual's creditworthiness or their ability to repay debts. This score plays a significant role in many aspects of an individual's financial life. It is important because lenders, such as banks or credit card companies, use the credit score to assess the risk of lending money to someone. A high credit score indicates a responsible borrower who is more likely to make timely payments, while a low credit score suggests a higher risk of default. A good credit score can open doors to better loan terms, higher credit limits, and lower interest rates, saving individuals money over time. Additionally, credit scores are considered by landlords, insurers, and even potential employers as a measure of an individual's trustworthiness and financial responsibility. It is crucial for individuals to maintain a good credit score by paying bills on time, managing debts responsibly, and keeping credit utilization low.

This mind map was published on 28 November 2023 and has been viewed 108 times.