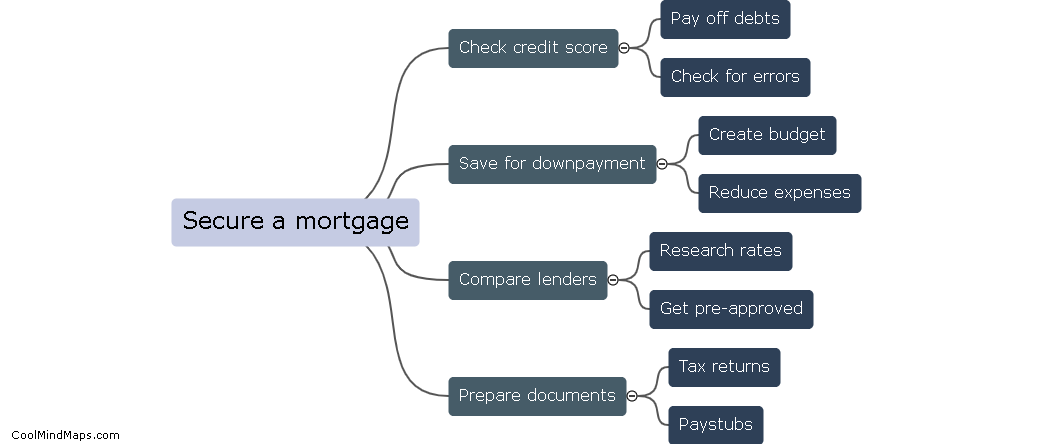

How do I secure a mortgage?

Securing a mortgage involves several key steps. First, you should check your credit score and report to ensure you are in good financial standing. Next, you will need to gather important financial documents such as pay stubs, tax returns, and bank statements. Shopping around for lenders and getting pre-approved for a mortgage will help you understand how much you can afford and what interest rates you qualify for. Finally, submitting a strong application with a down payment and undergoing a home appraisal and inspection will ultimately lead to securing a mortgage for your dream home.

This mind map was published on 3 August 2024 and has been viewed 70 times.