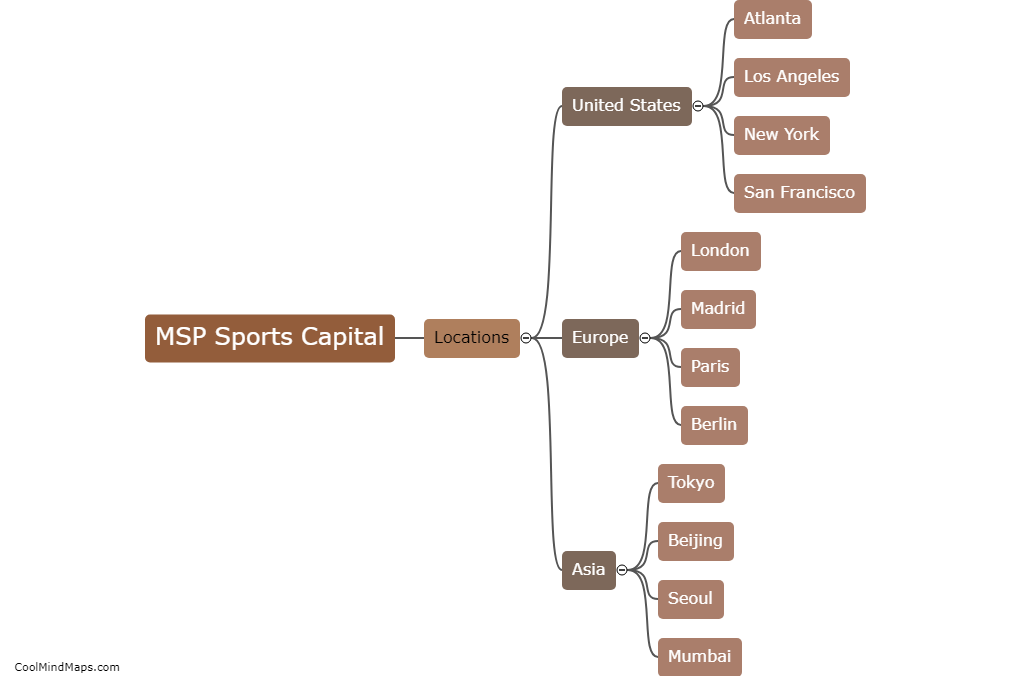

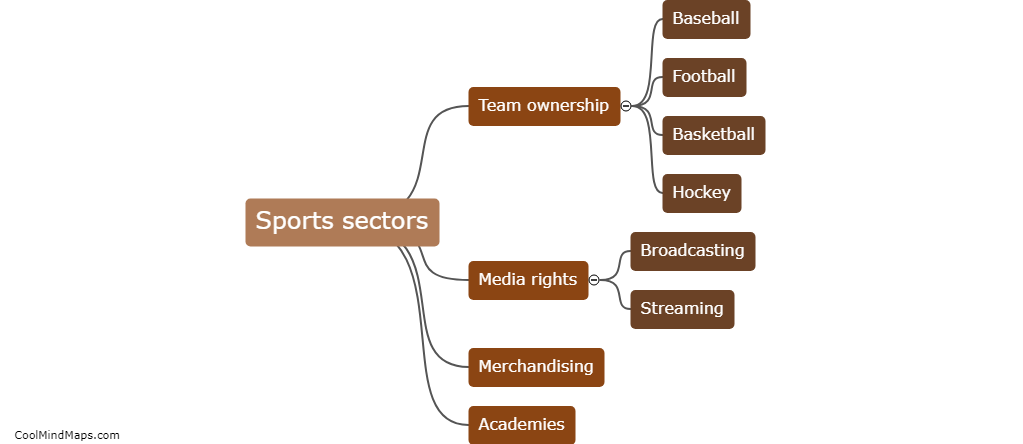

Which sports sectors does RedBird Capital Partners invest in?

RedBird Capital Partners, a private investment firm founded by Gerry Cardinale, has made significant investments in various sports sectors. With a focus on sports, media, and entertainment industries, RedBird has invested in a wide range of sports-related segments. These include professional sports teams in prominent leagues such as the National Football League (NFL), Major League Baseball (MLB), and Major League Soccer (MLS). Additionally, RedBird capitalizes on opportunities in sports media and technology, sports venues, and sports marketing. With their expertise and resources, RedBird has become a major player in the sports investment landscape, continually seeking opportunities to grow and enhance the sports industry.

This mind map was published on 2 November 2023 and has been viewed 106 times.