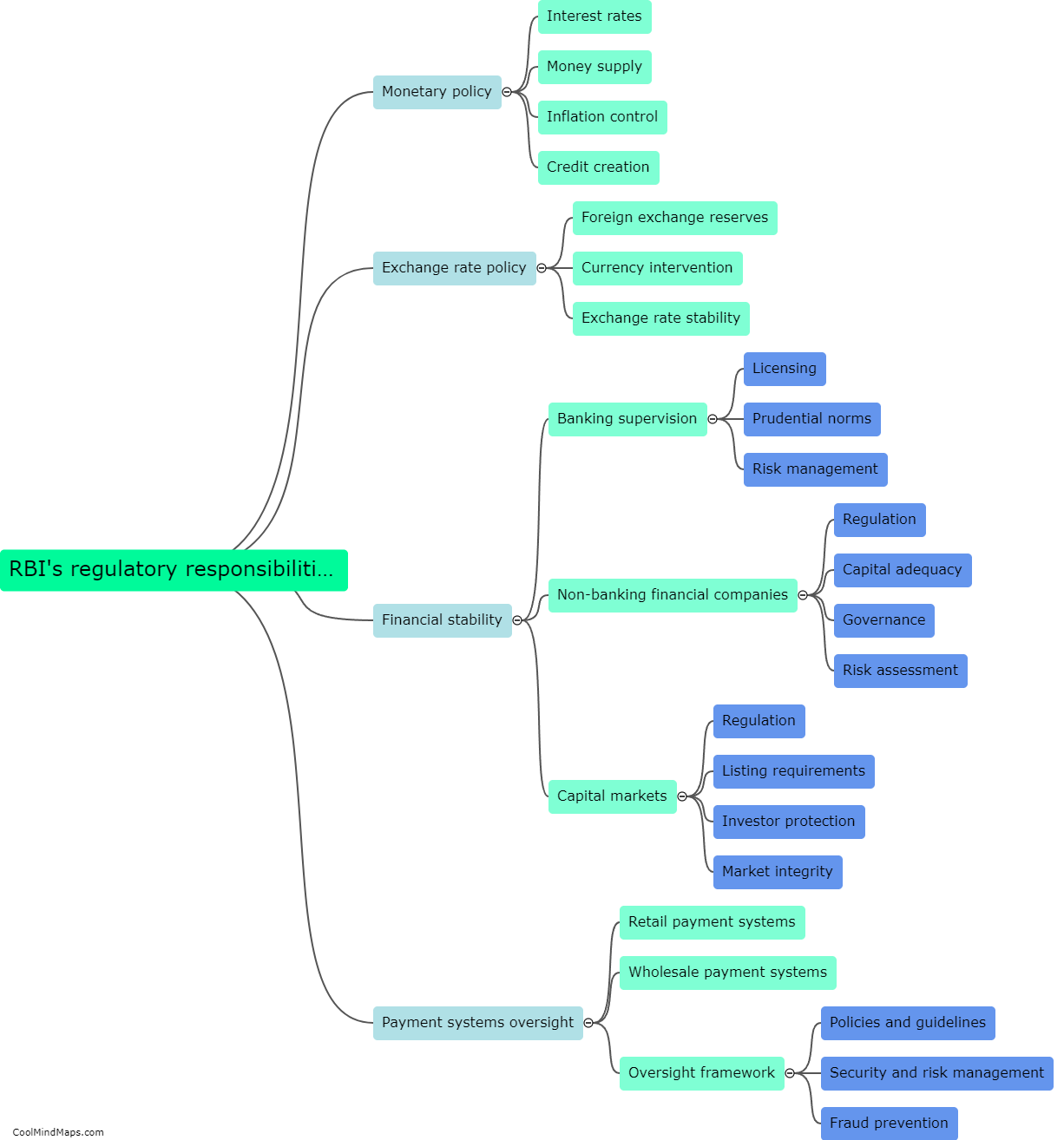

What are RBI's regulatory responsibilities?

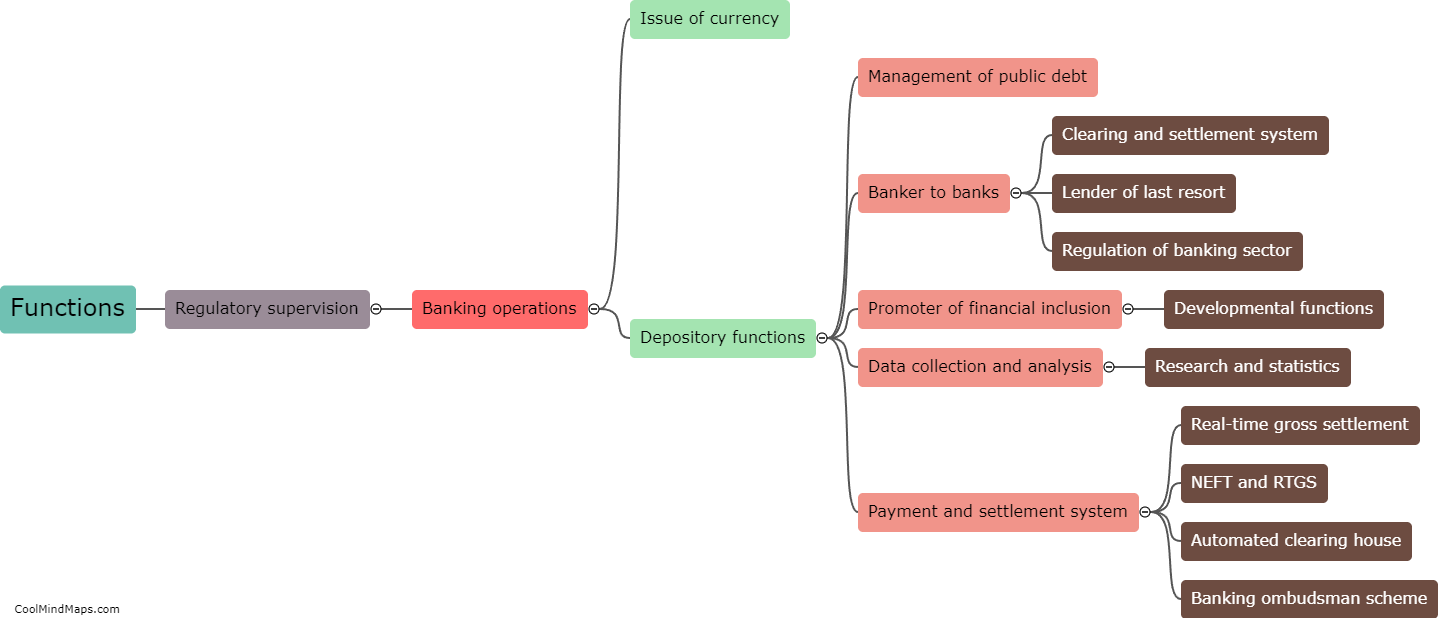

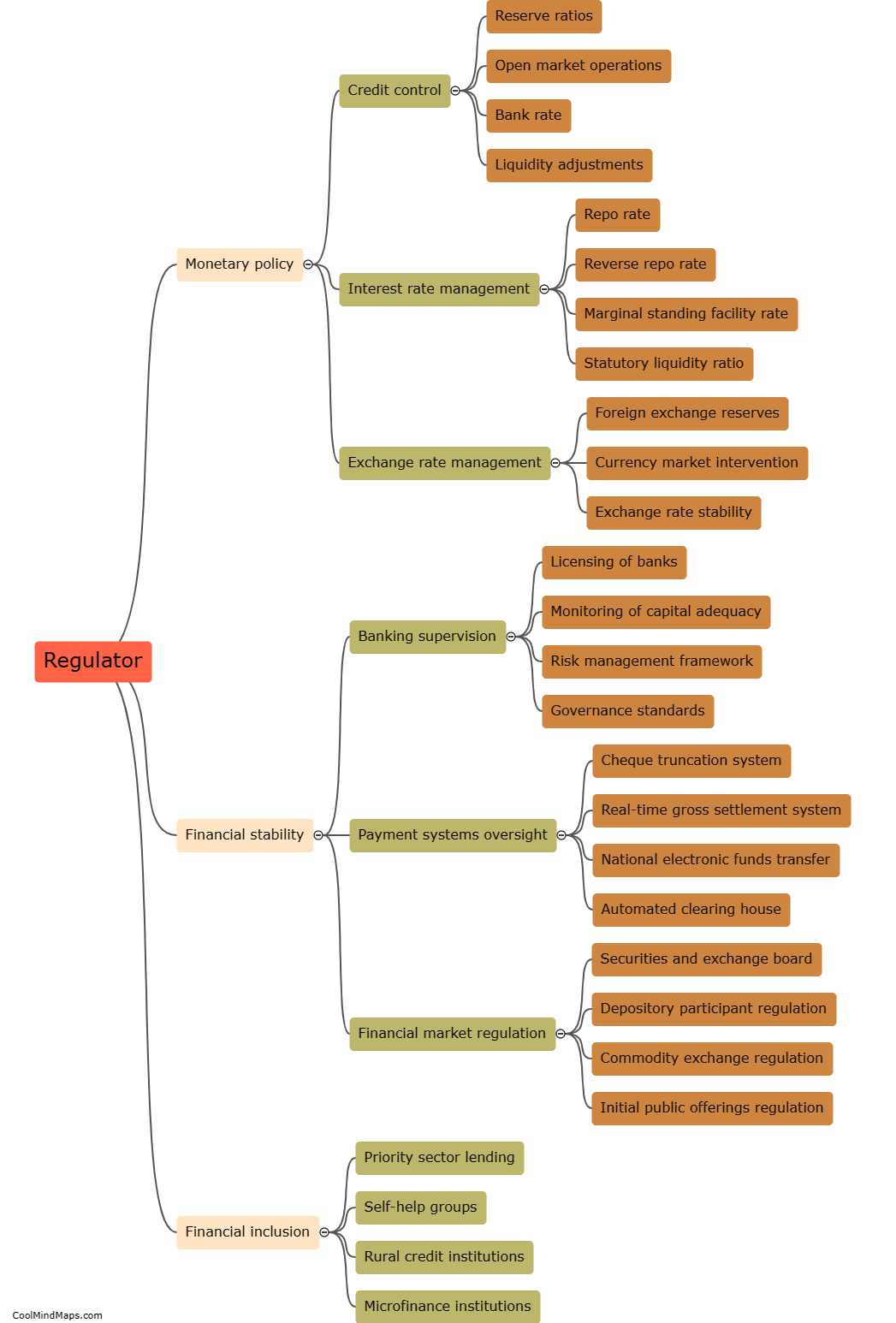

The Reserve Bank of India (RBI) has a wide range of regulatory responsibilities aimed at maintaining the stability and integrity of the Indian financial system. The primary objective of RBI's regulatory framework is to ensure the safety of depositors' money and promote sound banking practices. It formulates and implements various policies and guidelines to regulate banks, non-banking financial institutions, and other entities operating in the financial sector. RBI oversees the licensing and functioning of banks, monitors their financial health, and takes appropriate actions to address any concerns. It also regulates payment systems, foreign exchange transactions, and sets guidelines for risk management, capital adequacy, and asset classification. Additionally, RBI plays a crucial role in preventing money laundering, detecting frauds, and enforcing compliance with anti-money laundering rules and regulations. Overall, RBI's regulatory responsibilities play a vital role in promoting stability and confidence in the Indian financial system.

This mind map was published on 9 October 2023 and has been viewed 126 times.