What are the factors affecting the ISLM curve?

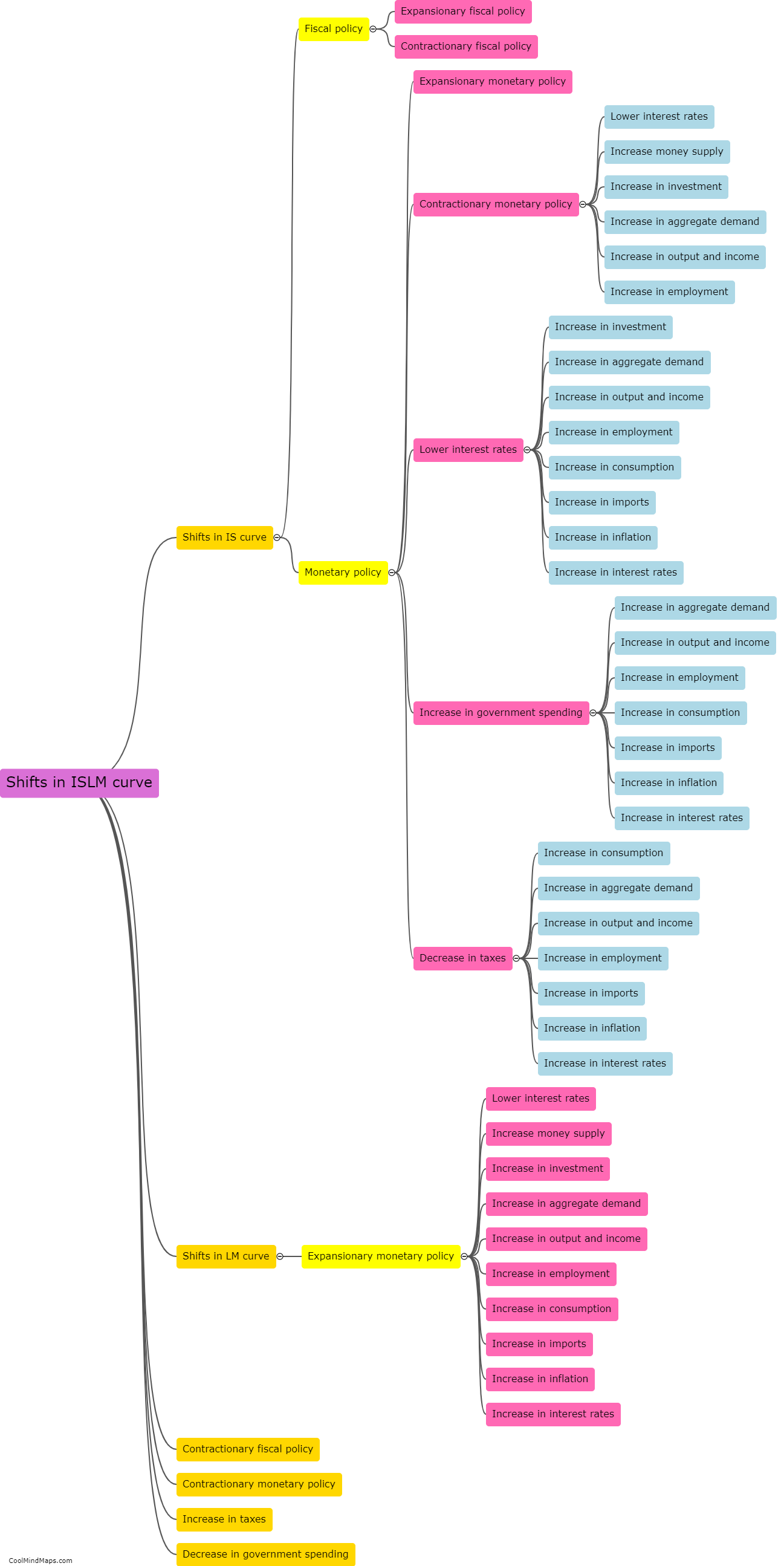

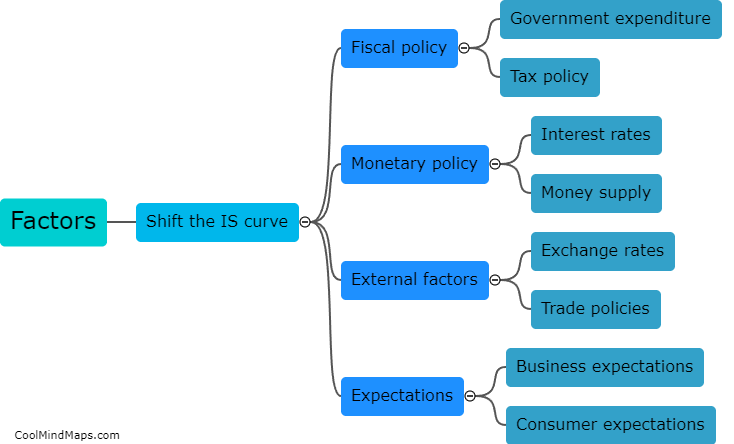

The ISLM model is an essential tool in analyzing the relationship between interest rates, output, and the overall level of economic activity. Several factors can influence the position and shape of the ISLM curve. Firstly, changes in fiscal policy, such as alterations in government spending or taxes, can shift the IS curve. Expansionary fiscal policy would increase government spending or reduce taxes, shifting the IS curve to the right, indicating higher levels of output. Conversely, contractionary fiscal policy would have the opposite effect. Secondly, changes in monetary policy, particularly adjustments in the money supply or interest rates, can alter the LM curve. An expansionary monetary policy like lowering interest rates or increasing money supply would shift the LM curve downward, reflecting lower interest rates and higher equilibrium output. Conversely, a contractionary monetary policy would shift the LM curve upward. Additionally, external shocks like changes in international trade, exchange rates, and global economic conditions can further affect the ISLM curve. Overall, the ISLM curve is influenced by fiscal and monetary policies as well as external factors, defining the equilibrium levels of output and interest rates in an economy.

This mind map was published on 3 October 2023 and has been viewed 102 times.