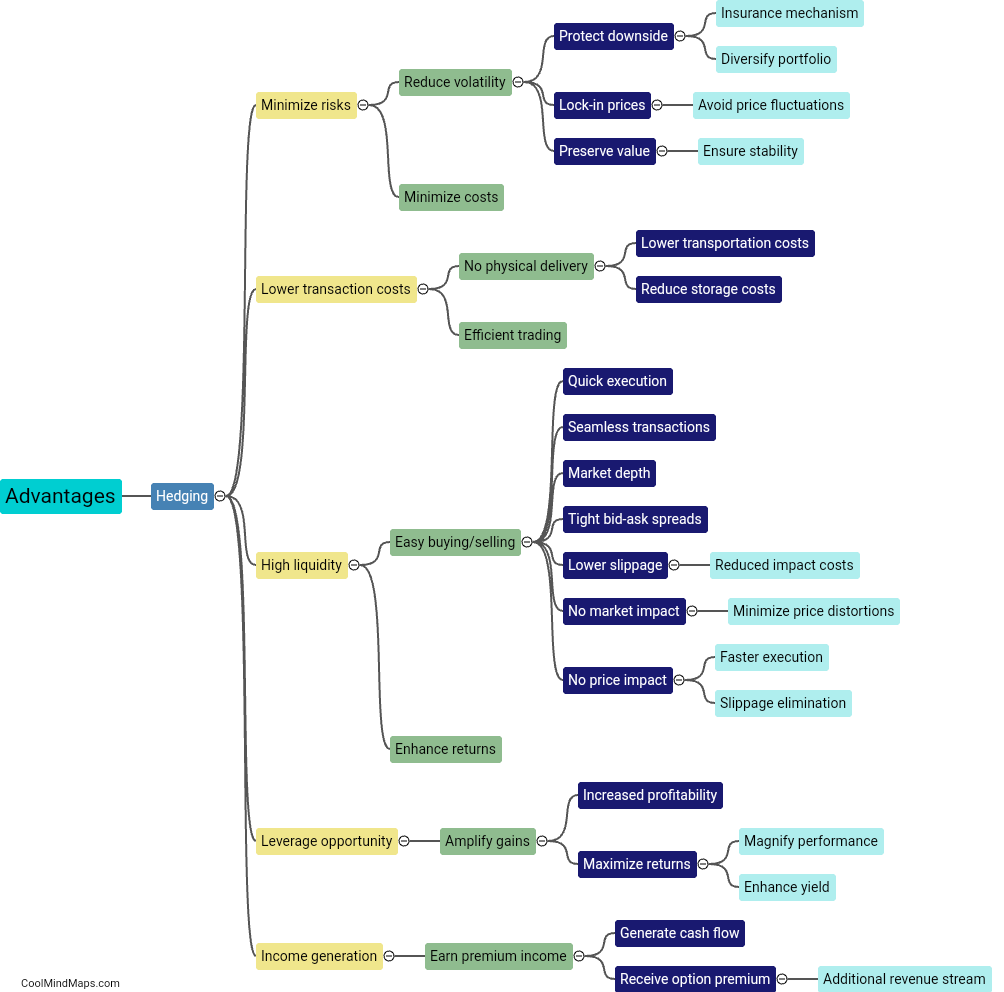

What are the advantages of using financial derivatives?

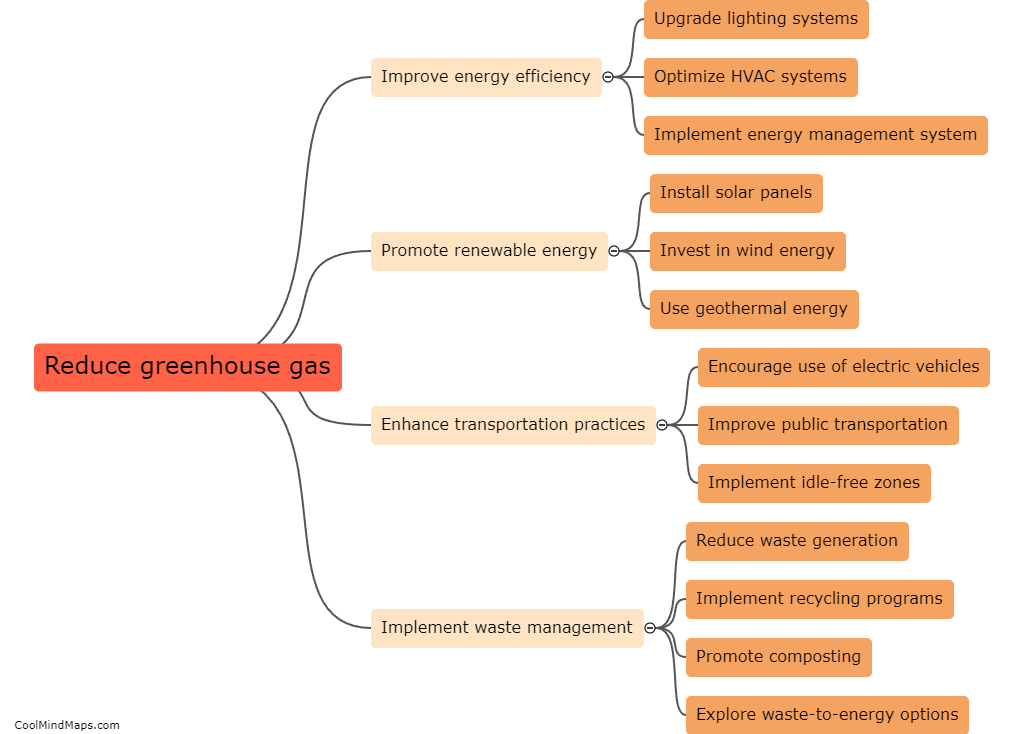

Financial derivatives offer several advantages to investors and financial institutions. Firstly, derivatives provide a means of managing and mitigating risks associated with price fluctuations in various financial assets such as stocks, commodities, or currencies. They enable investors to hedge their positions by taking positions that offset the potential losses in the underlying assets. This can protect against adverse market movements and reduce the volatility of investment portfolios. Secondly, derivatives allow investors to speculate and profit from price movements without owning and physically holding the underlying assets. This enables greater flexibility and accessibility to different markets and assets. Additionally, derivatives can provide leverage, allowing investors to gain exposure to larger positions with a smaller upfront investment. This amplifies potential returns and can enhance overall portfolio performance. Lastly, derivatives facilitate price discovery and market efficiency by providing a mechanism for participants to express and trade their views on future market movements. Thus, financial derivatives offer numerous advantages in terms of risk management, investment opportunities, and market efficiency.

This mind map was published on 22 January 2024 and has been viewed 141 times.