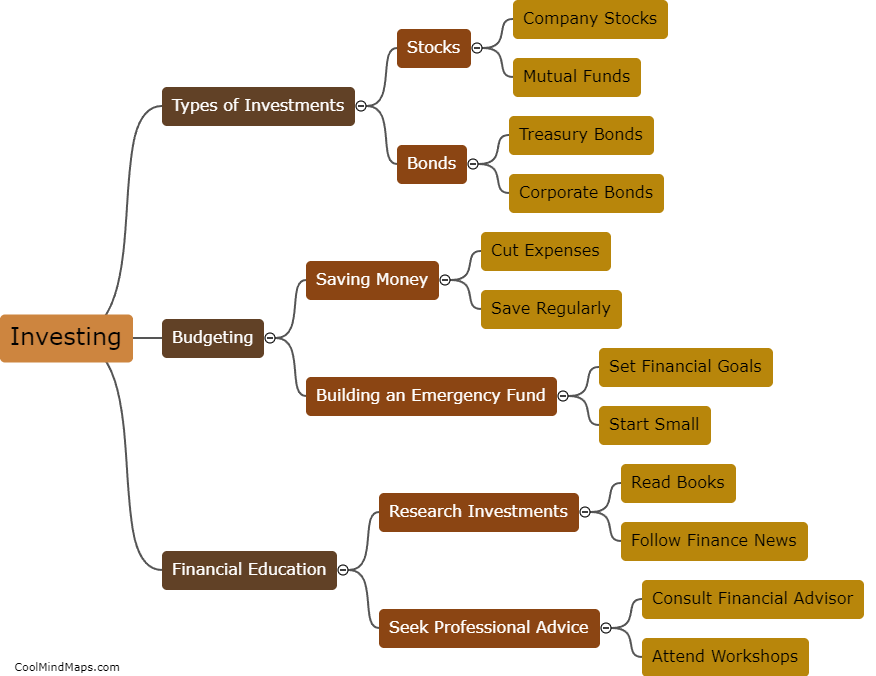

How can a student start investing with a small budget?

Starting to invest with a small budget can be intimidating for students, but it is not impossible. The first step would be to create a budget and determine how much money can be allocated towards investments. It is crucial to focus on low-cost options such as index funds or exchange-traded funds (ETFs) as they have lower fees and offer diversified portfolios. Researching and educating oneself about different investment options and strategies is also essential. Utilizing online platforms that offer fractional investing, where students can buy partial shares of individual stocks, is a great way to get started with limited funds. Additionally, taking advantage of investment apps or robo-advisors that automate the investment process and require lower minimum balances can help students start their investment journey. Regularly contributing a fixed amount every month, no matter how small, can gradually build up an investment portfolio over time.

This mind map was published on 26 October 2023 and has been viewed 87 times.